How to Send Money to Thailand with Wise: The Ultimate 2025 Guide for Travelers & Expats

Are you planning a trip to Hat Yai or moving to Thailand? Whether you’re a tourist, digital nomad, expat, or DTV visa holder, managing your money across borders can be challenging. Wise (formerly TransferWise) offers one of the most efficient and cost-effective solutions for international transfers and everyday spending in Thailand. In this comprehensive guide, we’ll cover everything from sending money to Thailand with Wise, using the Wise debit card, and choosing between personal and business accounts.

Why Choose Wise for Sending Money to Thailand?

Sending money to Thailand through traditional banks can be expensive due to hidden fees and poor exchange rates. Banks often add 3-5% markup to the exchange rate while charging high transfer fees. Wise eliminates these hidden costs by using the actual mid-market exchange rate—the same one you see on Google—with only small, transparent fees.

For example, transferring $1,000 USD to Thailand typically costs around $6.85 with Wise if you already have funds in your account. Compare this to traditional banks that might charge $20-40 plus unfavorable exchange rates, and the savings become substantial when you send money to Thailand with Wise.

Wise supports transfers to all major Thai banks including:

- Kasikorn Bank (up to 2,000,000 THB)

- Bangkok Bank (up to 2,000,000 THB)

- Siam Commercial Bank (up to 1,499,999 THB)

- Krungthai Bank, Bank of Ayudhya, and others (up to 500,000 THB)

The speed is impressive too—over 50% of transfers arrive instantly, and 90% complete within 24 hours when you use Wise to send money to Thailand.

160 countries and territories. 40 currencies.

Get the account built to save you money round the world.

Step-by-Step: How to Send Money to Thailand with Wise

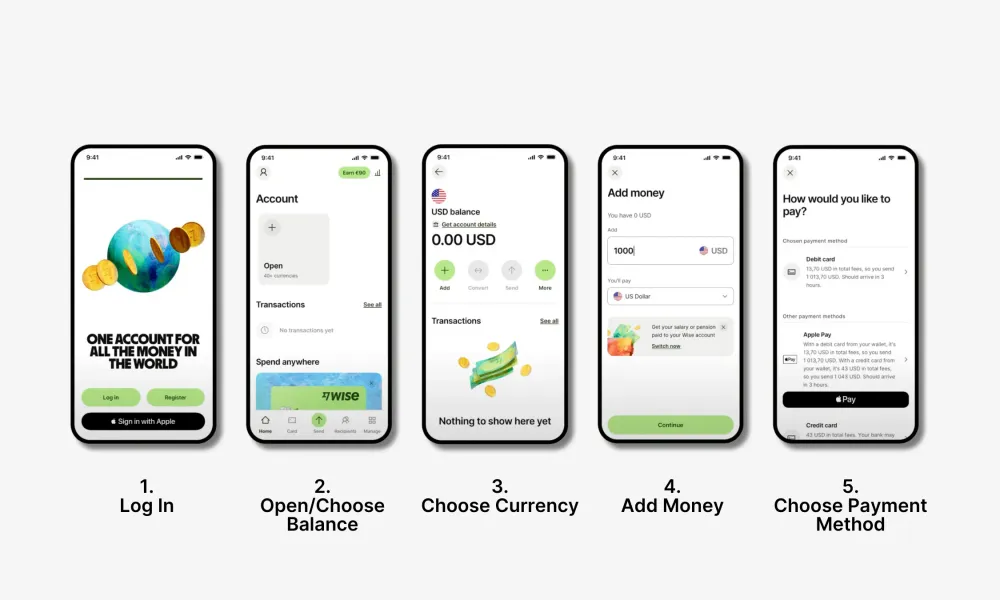

Create Your Wise Account

Sign up for a free Wise account online or via their mobile app. The verification process requires a government-issued ID and proof of address, which typically takes just a few minutes to complete.

Enter Transfer Details

Select the amount you want to send in your home currency, choose Thailand as the destination country, and enter the recipient’s Thai bank details (account name, number, and bank name).

Fund Your Transfer

You can pay via bank transfer, debit/credit card, or directly from your Wise balance. Using your Wise balance is usually the cheapest option as it avoids additional processing fees.

Review and Confirm

Wise will show you the exact exchange rate (locked for up to 48 hours) and all fees upfront. Once confirmed, you can track your transfer in real-time through the app.

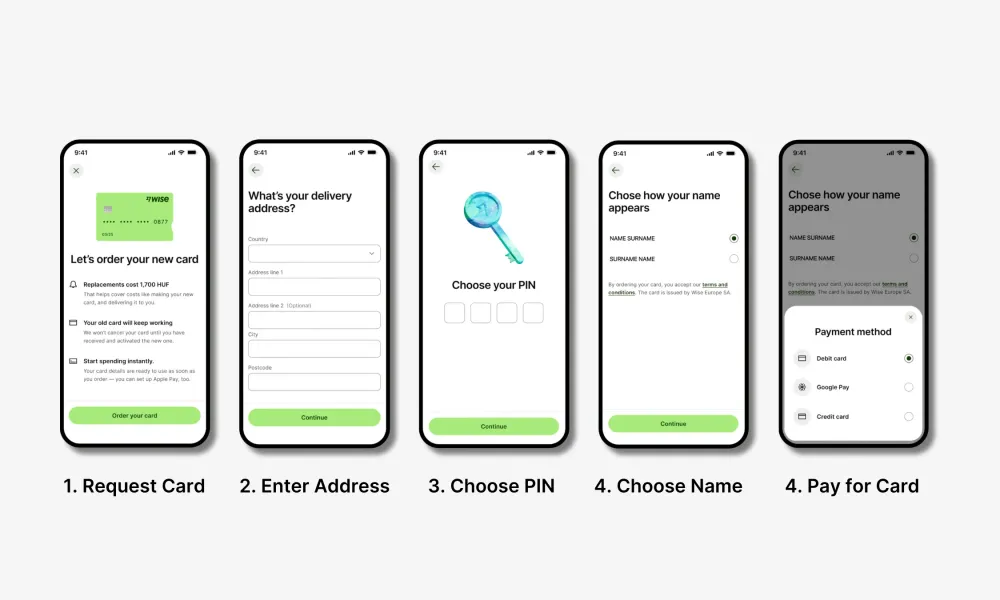

Using the Wise Debit Card in Thailand

The Wise debit card is a game-changer for travelers and expats in Thailand. It supports over 40 currencies, including Thai Baht (THB), and automatically converts at the mid-market rate with minimal fees. This makes it perfect for anyone looking to send money to Thailand with Wise and manage their finances efficiently.

Key Benefits for Thailand Visitors

| Feature | Wise Debit Card | Traditional Bank Card |

|---|---|---|

| Exchange Rate | Mid-market rate (no markup) | Marked-up rate (3-5% worse) |

| ATM Fees | Low Wise fee + Thai ATM charge | High foreign fees + ATM charge |

| Currency Support | 40+ currencies | Limited |

| Acceptance in Thailand | High (anywhere Visa/Mastercard accepted) | Varies |

| Best For | Travelers, digital nomads, low-cost spending | Local residents only |

ATM Withdrawals: You get two fee-free withdrawals per month (up to $200 USD equivalent), then 1.75% + $1.50 per transaction. Note that Thai ATMs charge 220-250 THB per withdrawal regardless, so it’s best to withdraw larger amounts less frequently when you use your Wise card in Thailand.

Spending: The card works anywhere Visa/Mastercard is accepted—perfect for hotels, restaurants, shopping malls like Central Festival Hat Yai, and local markets.

Wise Personal vs Business Accounts for Thailand

Best for: Tourists, digital nomads, expats, and DTV visa holders who want to send money to Thailand with Wise

- Hold 50+ currencies including Thai Baht

- Send to 170+ countries with low fees

- Free to open with no monthly charges

- Transfer fees start at 0.4% + fixed amount

- Perfect for receiving freelance payments

- Ideal for family support transfers

- Mobile app with real-time tracking

- Debit card for spending worldwide

Best for: Freelancers, remote workers, and small business owners operating in Thailand

- All personal account features plus business tools

- Batch payments (up to 1,000 at once)

- Team permissions and accounting integrations

- Earn 3.66% APY on USD balances

- Create local account details (EU IBAN, US routing)

- Volume discounts for high transfers

- Invoice in multiple currencies

- Multi-user access for teams

Special Considerations for DTV Visa Holders

If you’re in Thailand on a Digital Nomad Visa (DTV), opening a local Thai bank account can be challenging. Many banks require work permits or long-term residency documents that DTV holders may not have.

Wise solves this problem by providing the perfect solution to send money to Thailand with Wise without needing a local bank account:

- Borderless account with Thai Baht holding capability

- Local banking details in major currencies

- Ability to receive payments from clients worldwide

- Debit card for daily expenses in Thailand

- Low-cost transfers to Thai bank accounts when needed

This makes Wise an essential tool for digital nomads living in Thailand under the DTV program or other visa types who need to efficiently manage their international finances and send money to Thailand with Wise.

Tips for Banking in Thailand with Wise

- Always pay in Thai Baht: When using your card, choose to pay in local currency to avoid dynamic currency conversion fees

- Combine with local options: For larger amounts or specific needs, consider opening a Thai bank account alongside Wise

- Use PromptPay for local transfers: Once you have Thai bank account, link it with PromptPay for instant local transfers

- Track for taxes: Keep records of international transfers for tax purposes in your home country

- Set up rate alerts: Use Wise’s rate alert feature to get notified when exchange rates are favorable

- Use mobile app: The Wise mobile app makes it easy to manage your money and send money to Thailand with Wise on the go

Conclusion

Sending money to Thailand with Wise is straightforward, affordable, and perfect for travelers, digital nomads, and expats. Whether you’re funding your adventures in Hat Yai, paying for accommodation, or managing business expenses, Wise helps you avoid excessive bank fees and poor exchange rates.

With over 14.8 million users worldwide, Wise has proven to be a reliable solution for international money transfers. The combination of transparent pricing, real exchange rates, and excellent user experience makes it the top choice for anyone needing to move money to or from Thailand. Start using Wise to send money to Thailand today and experience the difference!

Frequently Asked Questions

Wise offers the cheapest transfers using the mid-market rate with low transparent fees, often under $7 for sending $1,000 USD compared to $20-40 with traditional banks when you send money to Thailand with Wise.

Yes! The Wise card works anywhere Visa/Mastercard is accepted in Thailand, including ATMs, hotels, restaurants, and shopping malls in Hat Yai. It automatically converts at the real exchange rate with minimal fees, making it ideal to send money to Thailand with Wise and spend locally.

Personal accounts are for individual use with basic transfer features to send money to Thailand with Wise. Business accounts add team management, batch payments, invoicing tools, higher limits, and earning interest on balances.

Over 50% of transfers are instant, and most arrive within 24 hours depending on the funding method and Thai bank. Transfers are significantly faster than traditional bank wires when you send money to Thailand with Wise.

Yes, Wise is regulated in multiple countries including by the FCA in UK and FinCEN in US, uses bank-level encryption, and holds customer funds in segregated accounts with major financial institutions like JPMorgan Chase, making it safe to send money to Thailand with Wise.

Absolutely! Wise is perfect for DTV visa holders who may have difficulty opening local Thai bank accounts. It provides borderless banking with THB holding capability, making it easy to send money to Thailand with Wise and manage finances without a local bank account.